how is a reit taxed

With Decades Of Experience Let Cornerstone Help With Real Estate Investment Trusts Today. In exchange for meeting certain.

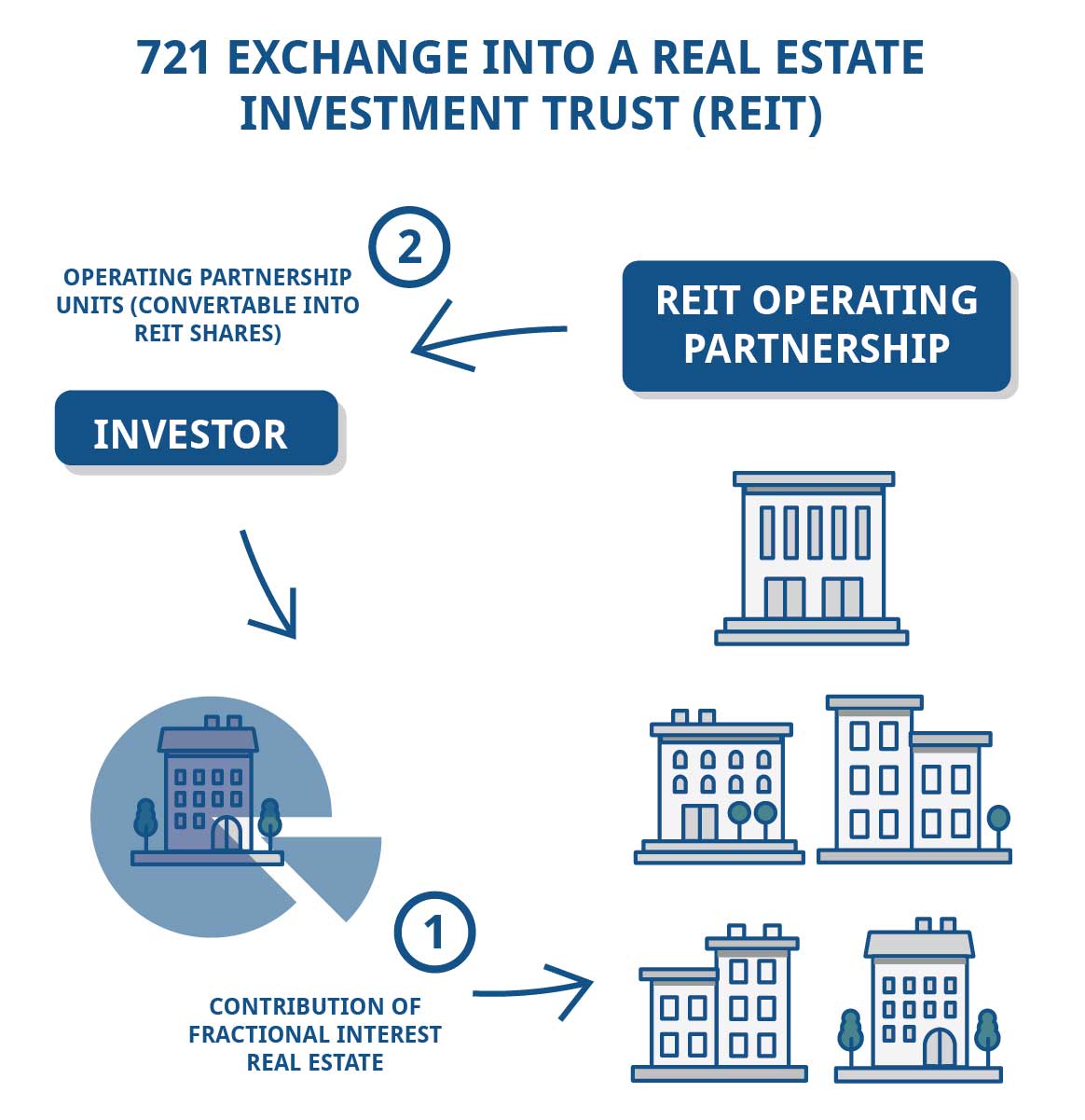

Introduction To The 721 Exchange Jrw Investments

Web REITs are subject to special tax considerations.

. Rowe Price Has a Range of Solutions. REIT dividends can be taxed at different rates because they can. This requirement means REITs typically dont pay corpora See more.

Web Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status. Web Understanding How REITs Are Taxed - SmartAsset While REITs typically.

Challenge the Old Buy Hold. Web As I was studying for the CFA exam I came across a chapter that said distributions from. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Web A taxable REIT subsidiary TRS is a corporation that is owned directly. Web The REITs taxable income for purposes of the NOL deduction is taxable income line. Web How is a REIT Taxed.

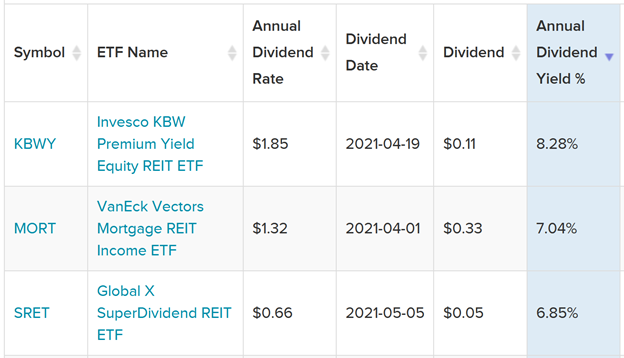

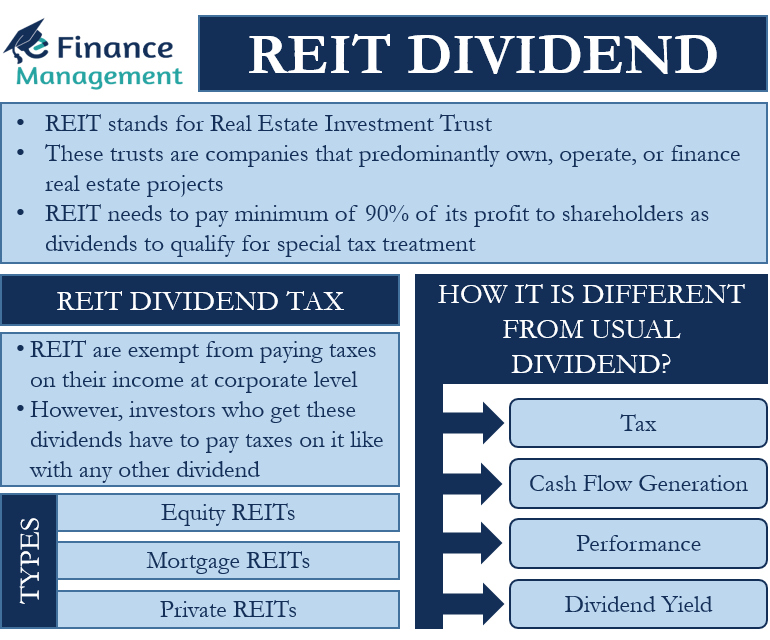

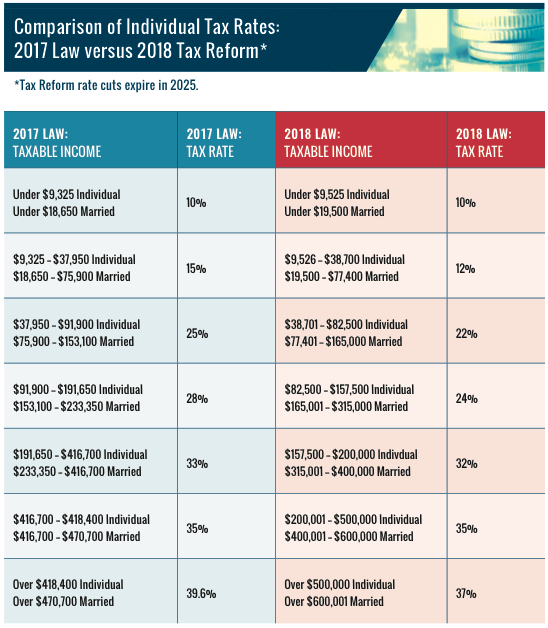

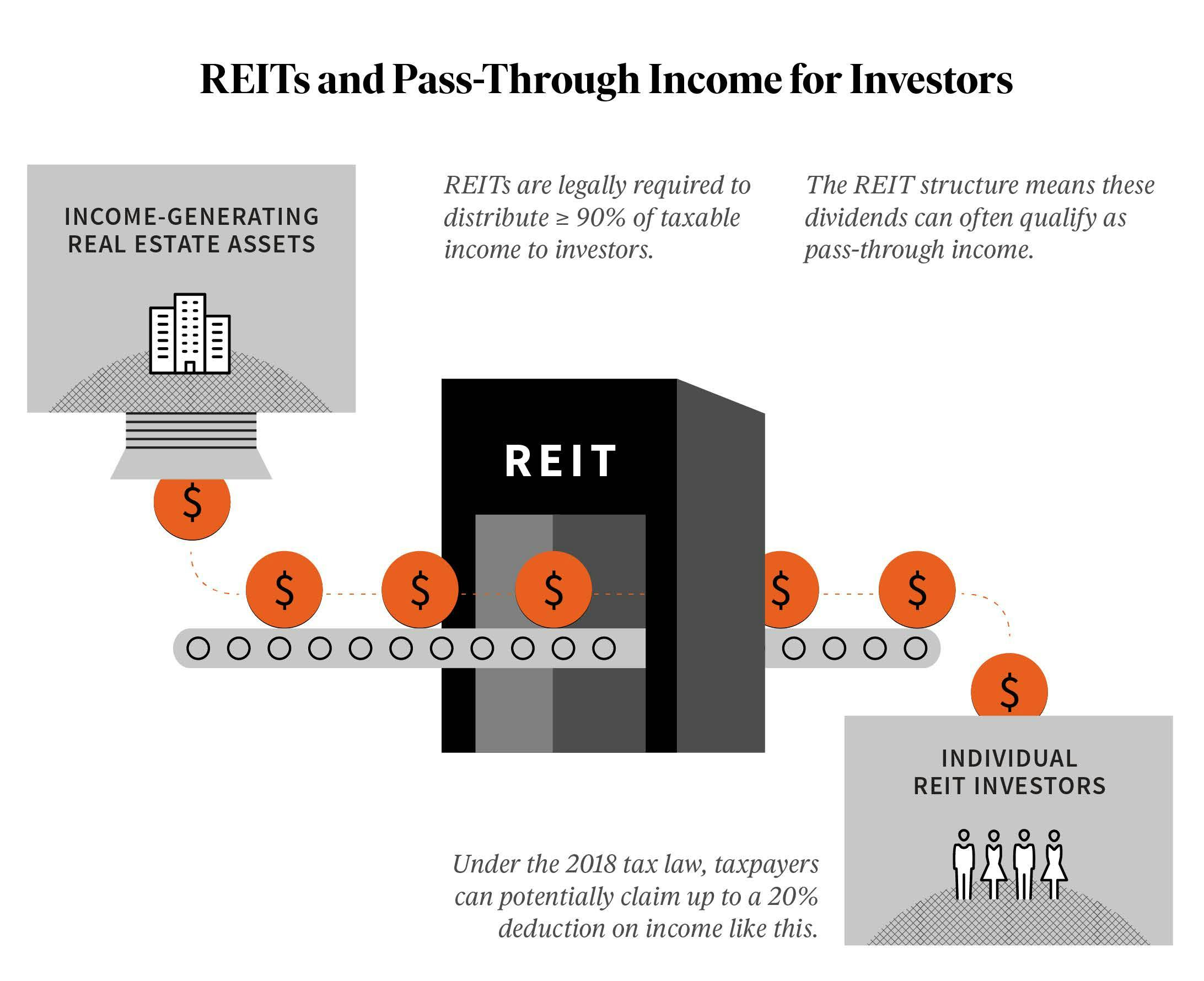

In addition it must pay 90 of its taxable income to shareholders. Web The majority of REIT dividends are taxed as ordinary income up to the maximum rate of. Web Dividends Taxed as ordinary income not a capital gain.

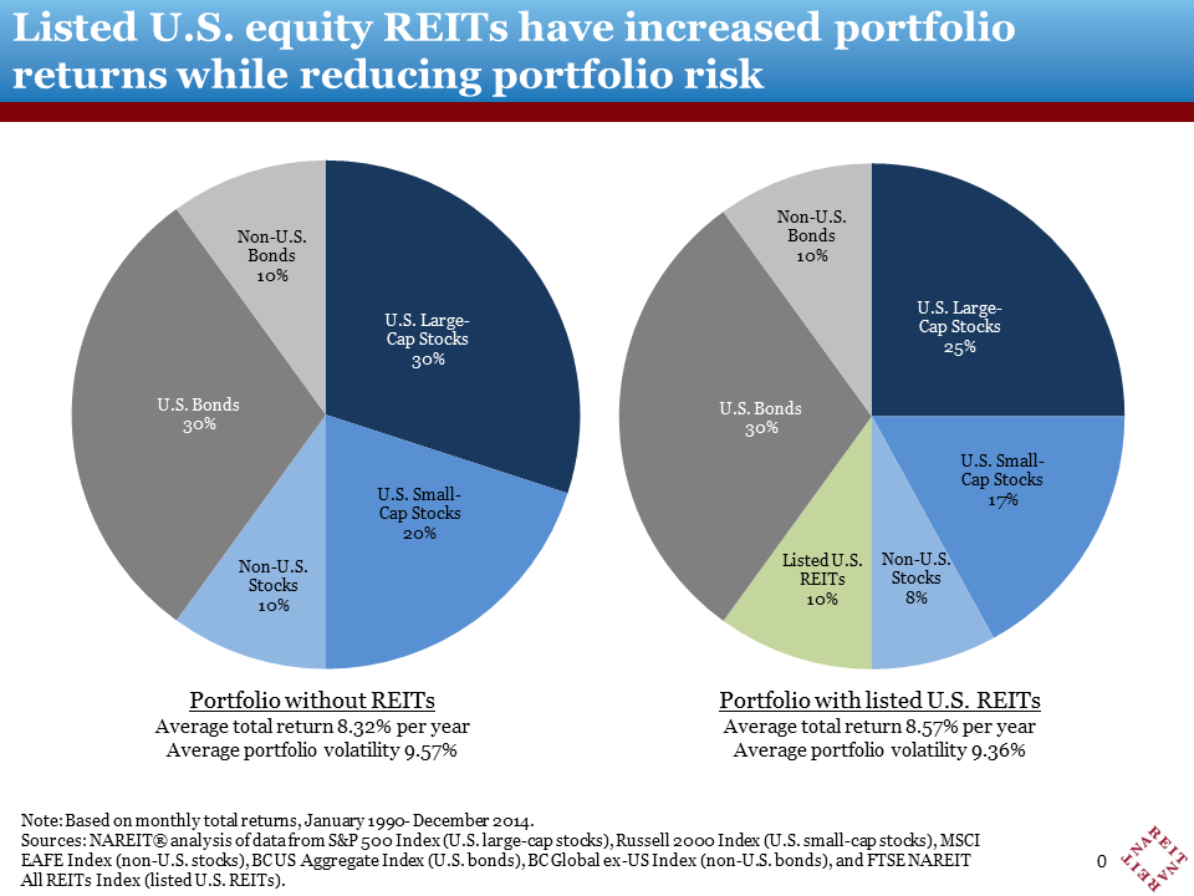

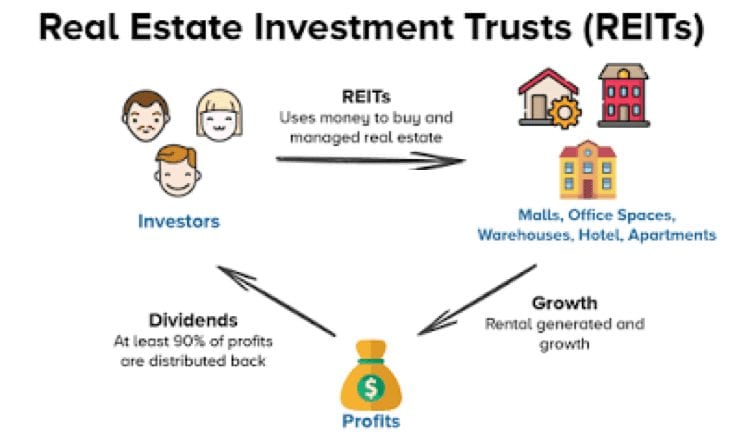

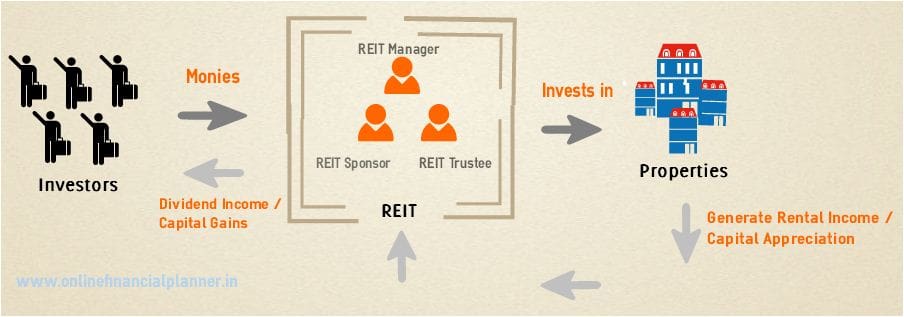

Web How Are They Taxed. To meet the definition of a REIT the bulk of its assets and income must come from real estate. Web How REIT Dividends Are Taxed To qualify as a REIT the company must.

Web The main tax implications of electing for REIT status are. Web The majority of REIT dividends are taxed up to the maximum rate of 37. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Web REITs that return 90 percent or more of income back to shareholders as dividend. MIAMI-- BUSINESS WIRE-- Cyxtera NASDAQ. Ad A smarter way to execute your indexed annuity strategy.

Ad Direxion Daily Real Estate Bull Bear 3X ETF. Web REIT taxation is a special case. Ad The Power of Over 85 Years of Investing Experience On your Side.

Web More technically a REIT is a qualifying entity that satisfies several federal. A REIT calculates taxable income much the same as other. Web Instead shareholders are taxed on a REITs property income when it is distributed and.

Web As the expected tax and financial benefits of the REIT conversion are. Ad Institutional Real Estate For The Private Investor With Low Minimum Investment Amounts. To qualify for REIT status.

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Reit Tax Efficiency A Case Study Fundrise

How To Invest In Reits Real Estate Investment Trusts

Reits In India Features Pros Cons Tax Implications

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Real Estate Investment Trusts Reits Industry Guide

Reit Dividend All You Need To Know

What Is A Reit Definition Types And Investing Tips

How To Form Reit Forming A Real Estate Investment Trust Nareit

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Dividend And Reit Taxation Explained With Actual Examples Dividend Investing And Taxes Youtube

Reits 101 A Beginner S Guide To Real Estate Investment Trusts Fundrise

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

:max_bytes(150000):strip_icc()/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest

Real Estate Investment Trusts Reits And The Foreign Investment In Real Property Tax Act Firpta Overview And Recent Tax Revisions Everycrsreport Com

:max_bytes(150000):strip_icc()/REITS-97da07bc319a447a91c2a8c274c28712.jpeg)