tax strategies for high-income earners 2020

Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. These contributions are not part of your gross income and are therefore not subject to income taxes.

The 4 Tax Strategies For High Income Earners You Should Bookmark

Fast And Simple Tax Filing.

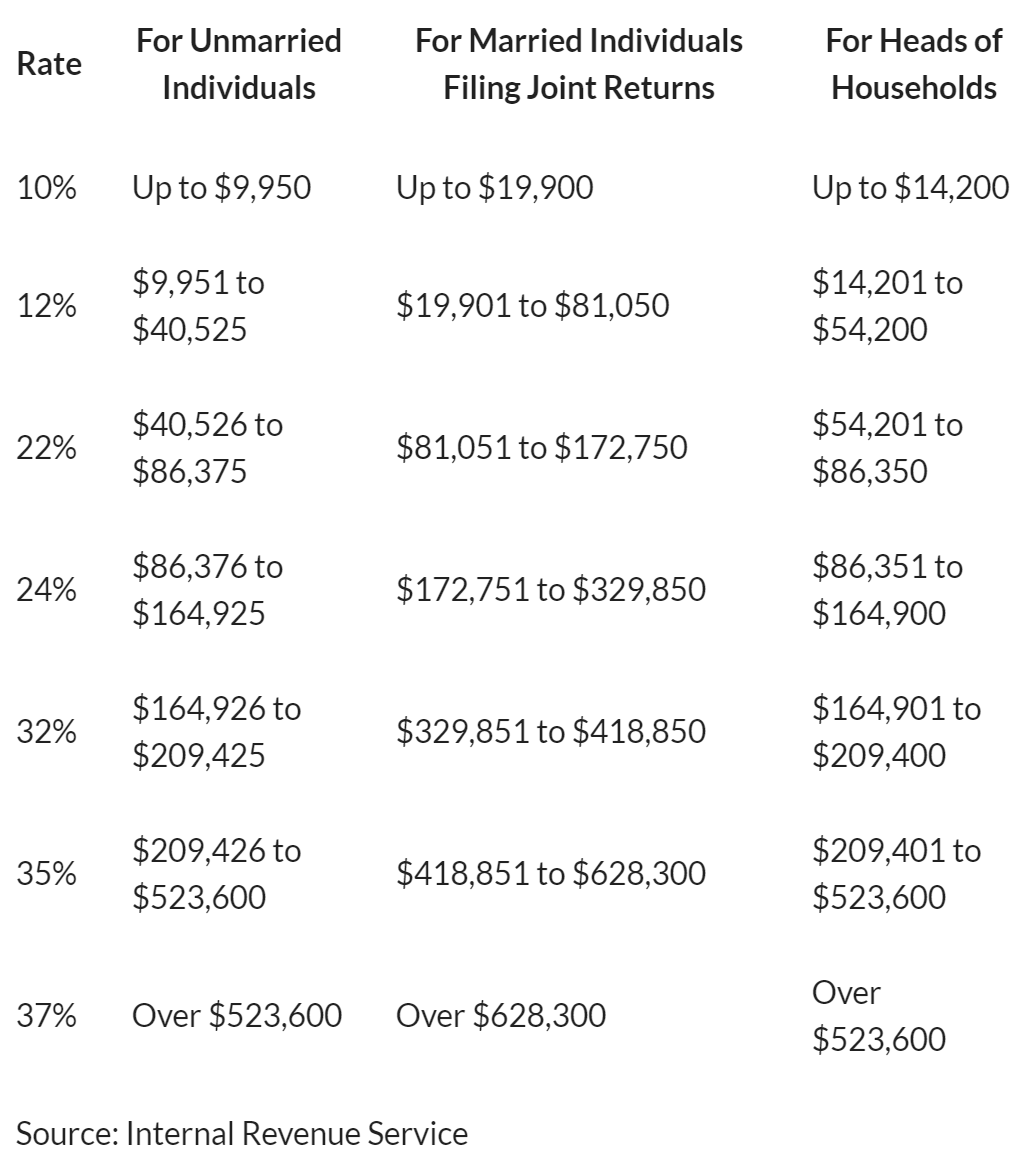

. 9 Ways for High Earners to Reduce Taxable Income 2022 1. These federal tax brackets enable one to understand the need and types of tax-saving strategies for high-income earners. Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate.

Employer-based accounts such as 401 k and 403 b accounts allow you. Get Your Max Refund Today. Household income is over 500k husband and wife work day jobs with over 200k in short term capital gain from day trading in this crazy market.

If your work or assets generate significant income you could pay up to half of your earnings to the US. Max out Retirement Accounts and Employee Benefits. July 24 2020 225242.

Donate Cash to a Charity. If your adjusted gross income AGI on line 11 is above 150000 then you need to at least withhold 110 of your 2020 total tax obligation. The law permits you to deduct the amount you deposit into a tax-certified retirement account from your tax return.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. Here are a few options. Just note that when you take this and other itemized deductions you forgo the standard tax deduction which.

After age 59-½ in the event that youve met the five-year run the show Roth dispersions are for the most part tax-free. Thats why its one of the most popular tax reduction strategies. Grab your 2020 tax return and your most recent pay stub.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. The IRS allow owners of resident occupied real estate to depreciate property over 275 years.

In case you claim a trade changing your trade structure can be a really successful charge lessening technique for high-income workers. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of current and future year contributions and deduct them all in the current year. Bxhxbbdjd Jul 8 2020 73 Comments Bookmark.

Use a Health Savings Account. 10 Those 50 or. Additionally you are not required to pay taxes on investment earnings from retirement accounts until you actually withdraw them.

We cant talk about tax strategies for high-income earners without mentioning real estate. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Convert your conventional SEP or Straightforward IRA to a Roth.

Easy Fast Secure. Sell Inherited Real Estate. What Are the Tax Strategies of High-Income Earners.

To be clear I dont mean the additional amount you had to fork over when. 201 Wilshire Blvd Floor 3 Santa Monica CA 90401 310 883-7975. Alright now that youve got the basics.

According to the IRS high-income earners pay almost 70 of the total federal income tax they collect. Invest in a Tax-Deferred Retirement Savings. The top bracket of.

Tax tips for high income earners. The main reason is that youre able to recover the cost of income-producing property through the use of depreciation. Take a Qualified Charitable Donation.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. In 2020 you can deduct the mortgage interest paid on as much as 750000 of a homes principal. Tax planning can be one of the most essential elements of tax-saving strategies for high-income earners.

Now may be an excellent time to purchase a home or opt for a cash-out refinance. Well need a couple of things for this. The higher your tax bracket the higher the benefits are of tax savings.

You make your contributions with pre-tax dollars as the money is deducted from your payroll. The importance of tax planning for high-income earners. Tax rates vary depending on the trends in the economy.

During the 2020 election campaign Democrats proposed to raise taxes on earners with more than 400000 of annual income cut them for. Contact a Fidelity Advisor. Lets start with retirement accounts.

Because any investment you make into your IRA excluding a Roth IRA SEP or 401 k is invested before. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions.

Get Your Income Taxes Done Right Anytime From Anywhere. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. 401k Plans On the off chance that you work for an organization that has 401K s exploit it.

Lets start by reviewing 1040 on your 2020 tax return. Max Out Your Retirement Contributions. One of my favorite tax strategies for high income earners is investing in real estate.

In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in 2021.

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Income Earners Wiser Wealth Management

7 Advanced High Net Worth Tax Strategies Not For Faint Of Heart

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiami Ta Business Tax Llc Business Accounting

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Minimisation Strategies For High Income Earners

Year End Tax Planning Strategies For Individuals Wheeler Accountants

Tax Planning Tips For Big High Net Worth Savings Pillarwm

4 Important Tax Strategies For High Income Earners

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Income Earners Lalea Black

The 4 Tax Strategies For High Income Earners You Should Bookmark

7 Advanced High Net Worth Tax Strategies Not For Faint Of Heart

7 Advanced High Net Worth Tax Strategies Not For Faint Of Heart

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown